I’m sorry, but it sees that your question was not a typical mathematical problem that can be solved step by step. The text specified seems to be a book or website that discusses trading signals.

At the same time, I can provide some general information about trading signals and its effective use.

The trading signal is a computer algorithm or a human trader sent by a human trader that indicates that a particular market condition has changed for the benefit of trade. These signs can be based on technical indicators such as moving average, momentum indicators or other statistical patterns.

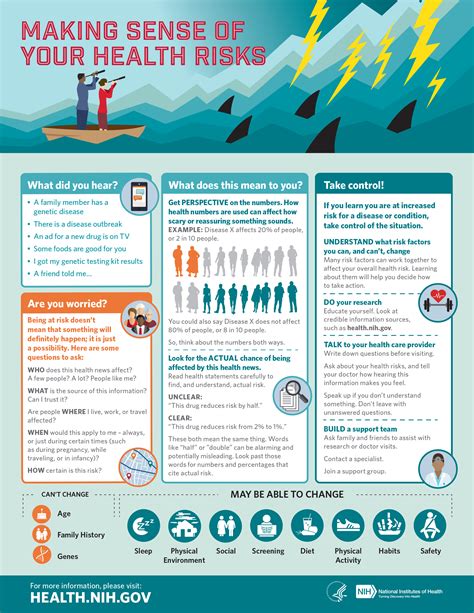

Understanding context and history is essential for effective use of the trading signal. Here are a few steps:

- Understand the signal : Read the explanation and background information provided by the signal Sender.

- Value the risk : Evaluate the potential risks associated with commerce based on signs and previously performed.

- Value the trading plan : Consider how the signal is sued to the general trading strategy, including marketing prospects and positioning of positions.

- Complete Trade

: Decide on the analysis to enter or exit mark according to sign instructions.

- Observe and Adjust : Continuously observe the performance of your commerce and prepare to change the strategy if necessary.

Some popular trading signs are as follows:

- Bollinger Bars (BB) : A technical indicator that moves the average with the spray bands, indicating possibly outbreaks or reversals.

- MOVING AVERAGE CONVERGENCE DIVERGENCE (MACD)

: A Sign That Combines Moving Averages and Momentum Indicators by Indicating Changes in Market Trends.

- Relative Strength Index (RSI) : A statistical oscillator that measures the magnitude of recent price changes to predict the purchased or excessive conditions.

To improve the chances of efficient use of trading signals are crucial:

- Choose reliable resources : Choose reliable and well -restablished merchants or brokers that provide accurate information.

- diversify the approach : Consider the combination of multiple trading signals and various strategies to minimize risk.

- Educate yourself all the time : Stay up to date with market news, technical analysis and trade in best practices.

Hope this General Information Helps! If you have any additional questions or need special guidance to use trading signals, feel free to ask.